charitable remainder unitrust calculator|charitable trust deduction calculators : Tagatay Charitable Remainder Unitrust Calculator. Please click the button below to open the calculator. American Heart Association Tax Identification Number: 13-5613797. Consider . Users who have seen the word "gyatt" used either in a TikTok video or in a caption may wonder what it means, but as it turns out, the word's meaning is actually fairly straightforward. The term is a shortened version of the word "goddamn."

charitable remainder unitrust calculator,Charitable Remainder Unitrust Calculator. Please click the button below to open the calculator. American Heart Association Tax Identification Number: 13-5613797. Consider .Estimate the benefits of creating a charitable remainder unitrust (CRUT) to support Oregon State University. Enter the gift amount, payment rate, and term length to see the .charitable remainder unitrust calculatorAn easy-to-use Charitable Remainder Trust calculator, or CRT calculator, to help calculate potential tax benefits, charitable tax deductions and returns.Estimate the benefits of creating a charitable remainder unitrust (CRUT) to support IJ, a public interest law firm. Enter the gift amount, payment rate, and term length to see the .

It provides steady cash flow and can be more beneficial than keeping an asset or selling it outright. Gift Amount ($) Gift Date. Payment Rate (%) Term Based On. Calculate. Your . The Charitable Remainder Unitrust (CRUT) Deduction Calculator serves as a valuable tool in the realm of charitable giving and financial planning. It aids in . Learn what a CRUT is, how it works, and its pros and cons. A CRUT is a trust that generates income and donates to charity, but it is irrevocable and has tax implications.There are two main types of charitable remainder trusts: Charitable remainder annuity trusts (CRATs) distribute a fixed annuity amount each year, and additional contributions .

Gift Date. Payment Rate (%) Term Based On. First Beneficiary Age. Second Beneficiary Age. Calculate. Your calculation above is an estimate and is for illustrative purposes .

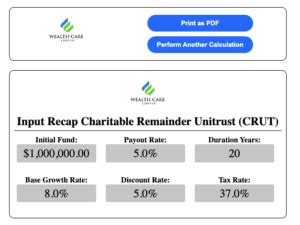

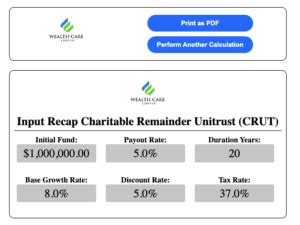

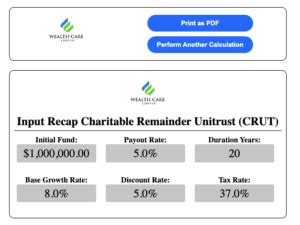

Charitable Remainder Unitrust Calculator. A great way to make a gift to IJ, receive payments that may increase over time, and defer or eliminate capital gains tax. It provides steady cash flow and can be more beneficial than keeping an asset or selling it outright. Your calculation above is an estimate and is for illustrative purposes only. Charitable remainder trusts can be structured as a fixed amount like a regular, annual salary (annuity trust) or as a percentage of the trust's total value (unitrust). Type of trust How it worksOr call us at 800-262-6039. A charitable remainder trust (CRT) is an irrevocable trust that generates a potential income stream for you, or other beneficiaries, with the remainder of the donated assets going to your favorite charity or charities. Learn how a CRT works and the benefits of pairing it with a donor-advised fund. A charitable remainder unitrust (CRUT) is an irrevocable, tax-exempt trust that generates income and provides a charitable donation to a chosen charity. It can be used to reduce taxable income . The Charitable Remainder Unitrust (CRUT) Deduction Calculator serves as a valuable tool in the realm of charitable giving and financial planning. It aids in determining the potential tax deduction associated with contributions to a CRUT. The formula for calculating the CRUT deduction is as follows: Formula of CRUT Deduction .Charitable Remainder Unitrust Calculator. A great way to make a gift to the American Cancer Society, receive payments that may increase over time, and defer or eliminate capital gains tax. It provides steady cash flow and can be more beneficial than keeping an asset or selling it outright. Your calculation above is an estimate and is for . Charitable Lead Unitrust; The calculator estimates the potential income tax charitable deduction based on the gift’s value, the expected payments to the individual beneficiary(ies) and the time horizon for those payments. Use the calculator to personalize a charitable remainder trust scenario. Consider Naming Your Donor-Advised Fund as . A Charitable Remainder Unitrust (CRUT) offers a unique opportunity for individuals to support their favorite charitable causes while simultaneously securing their own financial future. By contributing assets into a CRUT, donors receive a steady income stream for life or a specified term, potentially reducing their current income taxes through .charitable trust deduction calculators C. Calculation of Tax Deduction for Charitable Remainder Unitrust. Fair market value of property transferred. $1,000,000.00. Present value of remainder interest in unitrust factor as a percent. 75.58%. Present value of remainder interest = the tax deduction (Line 1 * Line 2) $755,820.00. 10% remainder interest test.

Note: Permissible unitrust percentages for charitable remainder unitrusts (CRUTs) are limited to a range of 5-50%. At funding, the present value of a CRUT’s charitable remainder interest as determined in accordance with the Treasury regulations must equal at least 10% of trust net assets, which further restricts allowable unitrust . A Charitable Remainder Unitrust carries three significant tax benefits. First, the sale of appreciated assets in a CRUT trust is tax-deferred; you pay no taxes when you sell, and the money you save can .The most popular and flexible type of life income plan is a charitable remainder unitrust (CRUT). Cash, securities, real property, or other assets are transferred into the trust. The trustee manages the trust assets and pays you or others you choose a variable income for life or for a term of years. When the trust terminates, the remaining .

Unitrust (CRUT): The non-charitable beneficiaries receive an annual payment equal to a percentage of the value of assets held in the trust. The minimum percentage is 5%. The minimum percentage is 5%.The methods for calculating a charitable remainder annnuity trust and a charitable remainder unitrust are different because the CRUT income stream fluctuates with changes in the value of the trust property. The technicalities involved in determining the value of the income stream or the remainder interest are much more complex for a CRUT.Charitable Remainder Unitrust Calculator A great way to make a gift to MPI, receive payments that may increase over time, and defer or eliminate capital gains tax. It provides steady cash flow and can be more beneficial than keeping an asset or selling it outright. A charitable remainder trust (CRT) is an irrevocable trust, meaning it cannot be modified or terminated without the beneficiary’s permission. Efficiently determine your charitable contributions using Hess-Verdon's Charitable Remainder Trust (CRT) Calculator. Ensure accurate and beneficial allocations.Overview. This calculation determines the donor's deduction for a contribution to a charitable remainder unitrust. Specify whether the trust lasts for a term of years, a single life expectancy, or a joint life expectancy (up to five ages). It also calculates the deduction as a percentage of the amount transferred.Charitable Remainder Unitrust. A charitable remainder unitrust gives you flexibility to accommodate a variety of assets, various financial goals, and the possibility of increasing trust payments over the trust term. If you wish to benefit from market upswings, but you don’t mind weathering market downturns, the unitrust may provide a perfect .

charitable remainder unitrust calculator|charitable trust deduction calculators

PH0 · how does a charitable remainder trust work

PH1 · chinese theorem calculator

PH2 · charitable trust deduction calculators

PH3 · charitable remainder unitrust deduction

PH4 · charitable remainder trusts for dummies

PH5 · charitable remainder trust calculator

PH6 · charitable remainder annuity trust calculator

PH7 · charitable annuity trust calculator

PH8 · Iba pa